Saturday - April 04, 2020

Saturday - April 04, 2020

Is capitalism now a crime?

Where do you draw the line between profit and profiteering? Should there even be one? What really is price gouging, other than reacting to market conditions? Ever read the James Clavell novel King Rat??

We’re in this emergency situation ... or we’re being lead to believe we’re in one. One of the major changes has been a massive increase in government power. Never let a crisis go to waste, right?

Here’s another case.

Brooklyn Guy Busted For Hoarding | Price Gouging

Federal agencies confiscated tens of thousands of medical supplies from a Brooklyn man who had been selling them at illegal marked-up rates from warehouses in New York and New Jersey.

The supplies have been sent to health departments in New Jersey, New York City and New York state, which will provide them to healthcare workers treating COVID-19 patients.

Among the items seized from the home of Baruch Feldheim, 43, were 192,000 N95 respirator masks, 130,000 surgical masks, procedure masks, N100 masks, surgical gowns, disinfectant towels, particulate filters, bottles of hand sanitizer, and bottles of spray disinfectant, according to the Department of Justice.

Feldheim was arrested Monday and accused of accumulating the items in order to sell them to doctors and nurses at inflated prices, according to New Jersey U.S. Attorney Craig Carpenito. Some of the supplies had been shipped from Canada, investigators said.

Feldheim was released March 30 on $50,000 bond. Feldheim will be paid fair-market value for the supplies, according to the Department of Justice.

“This is the first of many such investigations that are underway,” said Peter Navarro, DPA Policy Coordinator and Assistant to the President. “Our FBI agents and other law enforcement agencies are tracking down every tip and lead they get, and are devoting massive federal resources to this effort. All individuals and companies hoarding any of these critical supplies, or selling them at well above market prices, are hereby warned they should turn them over to local authorities or the federal government now or risk prompt seizure by the federal government.”

“If you are amassing critical medical equipment for the purpose of selling it at exorbitant prices, you can expect a knock at your door,” said Attorney General William P. Barr. “The Department of Justice’s COVID-19 Hoarding and Price Gouging Task Force is working tirelessly around the clock with all our law enforcement partners to ensure that bad actors cannot illicitly profit from the COVID-19 pandemic facing our nation.”

Sure, the guy was making a killing. But how is it that he was able to get his hands on this much PPE in the first place? Come on, get real, you KNOW he had none of this stuff on hand before Hannukkah. And tell me, please, what’s the price point line for this stuff? Just how much was he marking them up? Where’s the line?

Back when this all first hit, I bought 2 N100 masks from Amazon. 3M brand particular respirator model 8233. They cost me $13.60. EACH. It took weeks for my order to be delivered. I don’t know what these things used to cost, back in the days of reality. Because I’d never heard of the things, and when I did a bit of mask research, I found these were the best you could get. So I bought some. Better safe than rich, right? Did they used to cost a buck each? I have no idea. Maybe our all-powerful government will publish pricing guidelines, wholesale and retail. Control the market. Freeze the prices, like Nixon did. And that worked out so well, right?

I notice that the seller, Hugo’s, no longer has the masks. But they do have toilet paper. Commercial size rolls, unknown brand, 2 ply, great big 500 sheet rolls. Carton of 96 for $123.64. So that’s 4 times as many rolls as the big 24 pack you can buy in the store, and each roll is quite a bit bigger. So figure it as equal to 5 24 packs. Do those cost $24 each? Or are they only $12? Is this price gouging too?

Posted by Drew458

Filed Under: • Finance and Investing • FREEDOM • Jack Booted Thugs • Pandemic Pandemonium •

• Comments (0)

Monday - March 16, 2020

Monday - March 16, 2020

Free Money Again

$700 Billion In Quantitative Easing To Ensue

The Federal Reserve announced on Sunday that it dropped its benchmark interest rate by a full point and launched a massive $700 billion quantitative easing program.

“The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook,” the Federal Reserve said in a statement. “In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

If you’ve forgotten what QE is, in hopes of never hearing it again after the Obama years, it’s the Fed buying up a ton of government bonds with several plane loads full of the cash they print out. If nothing else, it dumps a whole lot of cash into the market.

A central bank implements quantitative easing by buying specified amounts of financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the money supply.

If nothing else, this ought to drop mortgage rates even further than their current never-ever-been-this-low level. So it’s a good time to refinance. A local bank was offering a 2.89% refi 10 days ago; we’re tempted. Especially if that drops a couple more points.

~~~~

The stock market is diving again too. Might be a good time to invest in things you know are going to rebound, like energy stocks.

Posted by Drew458

Filed Under: • Finance and Investing • Pandemic Pandemonium •

• Comments (0)

Thursday - March 12, 2020

Thursday - March 12, 2020

Bears Rampage On Wall Street

Markets Tank. Worst Drop Since 1987.

Dow down 10% in one day; drops 2352.60. NASDAQ and S&P 500 both down about 9 1/2%.

This is on top of losses earlier this week and some recovery the day after.

Airlines and cruise ship companies hit severely, losing 17 - 36%. Hotel booking companies also hit.

Stock markets in Europe and Asia also hammered.

U.S. equity markets cratered Thursday despite another flood of liquidity from the Federal Reserve after President Trump suspended travel from Europe for 30 days in an effort to contain the spread of the corona10 percent.

The S&P 500 entered a bear market down about 8 percent while the Nasdaq did as well dropping nearly 8 percent. Trading in U.S. equity markets was halted briefly just minutes after the opening bell when the S&P fell by 7 percent.

The entry into bear market territory was the fastest on record for the S&P and Nasdaq as tracked by the Dow Jones Market Data Group.

Stocks briefly trimmed some losses, before selling resumed after the New York Federal Reserve injected $1.5 trillion of fresh liquidity into the bond market.

The decline was the worst since the Black Monday crash of 1987 when the index lost 22 percent of its value in a single day

Posted by Drew458

Filed Under: • Finance and Investing •

• Comments (0)

Wednesday - December 09, 2015

Wednesday - December 09, 2015

Germans to Greeks. Do as you’re told. Again. IMF wants monies on loan paid on time. lol!

Germany to Greece. Shut up and do as you’re told. Again.

Couldn’t resist that line. That isn’t an exact quote but close enough.

Not that it’s a major story. Just a short bit in the business section, which I rarely read.

But it caught my eye and attention.

One headline reads;

Tension grows over IMF’s role in Greek program

Another reads;

Lay off the IMF, Germany warns.

Woo-hoo. Is it to be war then?

To boil it down without reading the whole thing, which I’ll post for anyone interested. And I am , cos I see it as a sit-com.

Greece to IMF. “What? Pay back a loan? Why? How long has that been going on”?

The German finance minister warned Greece not to question the involvement of the IMF in its bailout program. This was after the Greek PM, Alexis Tsipras said the global lender was making unrealistic reform demands on Greece.

That’s it in a nutshell.

However … things got kind of messy and the German finance minister felt the Greeks needed some advice.

Here’s the longer version.

IMF’s role in Greek program

Tension between Greece and its lenders grew on Tuesday when German Finance Minister Wolfgang Schaeuble seized on comments by Greek Prime Minister Alexis Tsipras regarding the involvement of the International Monetary Fund in the Greek bailout program.

During a TV interview on Monday night, Tsipras indicated that he is not keen on the IMF joining the program because of the demands it is likely to make.

“The Fund must decide if it wants a compromise, if it will remain a part of the program,” said Tsipras. “If it does not want to, it should come out publicly and say so.”

Speaking on the sidelines of Tuesday’s Ecofin meeting, Schaeuble slammed Tsipras’s stance. “It is not in Greece’s interests for it to question the IMF’s involvement in the bailout program,” he said.

· “I believe we negotiated at length with Mr Tsipras in July and August,” added Schaeuble. “I also believe that he signed the agreement and then held elections to get a mandate from the Greek people so he could implement what he signed.”

The German finance minister also indicated that he has the impression Tsipras is having second thoughts about adopting some of the measures demanded by Greece’s lenders.

“They should focus their attention on doing what they have to do,” he said. “As always, they are behind schedule. Maybe questioning the agreement is necessary for domestic reasons; he has a slim majority I have noticed. This may be the easy route but it is not in Greece’s interests.”

Schaeuble’s comments prompted an immediate response from Athens. “We remind that the Greek government is responsible for deciding what is in the country’s interests,” said government spokeswoman Olga Gerovasili.

“We expect the German Finance Ministry to separate its stance from the unacceptably tough stance of the IMF,” she added. “Europe should and is able to solve its problems on its own.”

Greek government sources believe that Schaeuble’s comments indicate there is a split within the German government over Greece.

Posted by peiper

Filed Under: • Disasters • Economics • Finance and Investing • International •

• Comments (2)

Friday - December 05, 2014

Friday - December 05, 2014

BILLED AS THE WORLD’S MOST BEAUTIFUL GIRL. AT 9.

Well, this outta get tongues wagging. Not sure what I think.

The make up ppl say she isn’t even wearing actual lipstick. Read the article for info on that.

There is no question in my mind that although she is already becoming a successful pre teen model, this is one very beautiful young girl.

Now come the serious question.

Can her look be seen as a sexy one?

Her mother says no and that anybody who sees her daughter as “sexy” is a pedophile.

Not so sure I agree. I think a pedophile prefers children to begin with. Least that’s what I have read. They target children almost exclusively.

However, I think there’s a huge difference between criminal behavior or leanings to that, and seeing the image here as quite a sexual appearance for a 9 year old.

See the link and take a good look at all the photos.

One thing is certain tho. She doesn’t get these looks from mummy. There’s a goddess at work here somewhere.

EXCLUSIVE - ‘You must think like a paedophile to see sex in these pictures… go see a doctor’: Mother of world’s most beautiful girl defends ‘provocative’ images that show her nine-year-old daughter in hotpants

Kristina, aged nine, is ‘world’s most beautiful girl’ with supermodel career

Mother posts images to millions of followers oan Facebook and Instagram

But critics say the pictures of nine-year-old in shorts are too provocative

Men have posted comments such as ‘sexy legs’ and mum was attacked

Today Glikeriya hits back at ‘paedophile critics’ with sick imaginationsBy Will Stewart In Moscow for MailOnline

The mother of a child supermodel dubbed ‘the most beautiful girl in the world’ has attacked ‘paedophiles’ who say she is sexualising her daughter by posting provocative pictures of her.

Kristina Pimenova is just nine years old but has become a worldwide sensation after pictures of her triggered a storm of criticism on Facebook and Instagram.

Today her mother Glikeriya Pimenova, who runs the social media accounts and posted the pictures, hit back in an exclusive interview with MailOnline, saying: ‘I do not accept those accusations about sexualisation of my child.

‘I am certain in my mind all her photographs are absolutely innocent. I have never asked her to take this or that pose, and in fact I must say she does not especially like it when I am photographing her, so I do it quickly and when she doesn’t notice.’

Innocent pictures of Kristina, whose impressive achievements have already seen her starring in adverts for Armani, Roberto Cavalli and Benetton, became the subject of disturbing comments online.

But Glikeriya, 39, told MailOnline: ‘You must think like a paedophile in order to see something sexual in these pictures, so it is time for you to see a doctor.

‘Some years ago I posted a picture of little Kristina on the beach in the Maldives hugging her three soft toys and laughing.

‘She was holding all her toys in front of her chest and hugging them, and you know what comments I got to this picture?

‘’Oh, she is covering her breasts because she thinks she has something to hide!’ Can you believe it? I think people who post something like this have serious psychological problems.’

Sipping fruit tea and clearly stung by the accusations, Glikeriya insists ‘All her ‘poses’ are natural. She is just a little girl who is attracting a lot of attention and unfortunately some of this attention is coming from strange people with huge personal problems, keen to throw dirt at anyone.’

Glikeriya insists the problem is a minority who visit their own prejudices onto entirely innocent and beautiful pictures.

Her portfolio from a remarkable six year ‘career’ is simply astonishing, including Vogue and Armani, yet critics see a dark side with one commentator branding a photo of her in shorts as ‘creepy’ while a male user wrote worryingly: ‘I like it’.

Sitting in a fashionable Uzbek restaurant in the elite Krylatskoe district of Moscow, Glikeriya calmly sought to correct what she sees as the misplaced criticisms of her own motives, and her daughter’s poses.

‘We lived in France when I was expecting Kristina,’ explained Glikeriya, dressed simply in jeans, a pink jumper and Loius Vitton scarf. At the time, her husband played for FC Metz.

‘I went to Moscow to give birth and soon afterwards returned to France, so Kristina was born in Russia,’ she said.

‘Until the age of three we lived in France and I was astonished to see the amount of attention she attracted from people who saw her.

‘In any public place we visited, people just surrounded her and keep repeating ‘Oh, such a sweet child’, ‘look at her’, and similar comments.

‘Kristina really enjoyed such attention but it was only abroad, I am afraid. When we came back to Russia it was a shock for my child.

‘I remember she was sitting in her pram as I pushed her, and she kept smiling to everybody who passed by, but nobody cared. She turned to me with pure shock on her face - what’s wrong?

‘But I knew she was cute and decided to give it a try. I browsed the internet and found the model agency for children with the most attractive and easy to understand website, and sent them Kristina’s photographs.

‘We were invited for a chat and she was added to their database. Her first photo session took place a little before her fourth birthday. When she turned four, we had our first portfolio done.’

I do not accept those accusations about sexualisation of my child

Glikeriya PimenovaHer ‘career’ exploded as Kristina’s image was demanded both in Russia and worldwide. Her daughter’s Facebook has more than 2.1 million likes, and she has 315,000 followers on Instagram.

CONTINUES HERE WITH MORE PIX COMMENTS AND VIDEO

Posted by peiper

Filed Under: • Art-Photography • Economics • Eye-Candy • Finance and Investing • Family •

• Comments (7)

Wednesday - February 12, 2014

Wednesday - February 12, 2014

If this keeps up …

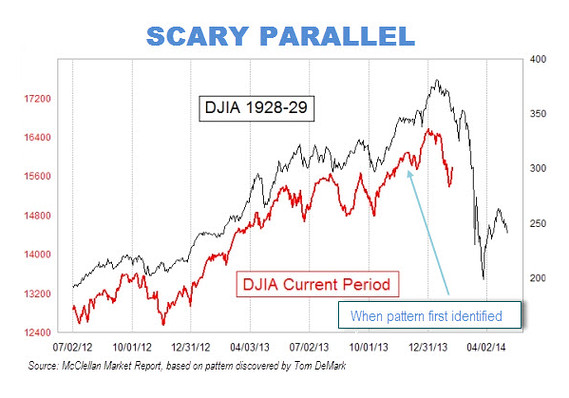

There are eerie parallels between the stock market’s recent behavior and how it behaved right before the 1929 crash.

That at least is the conclusion reached by a frightening chart that has been making the rounds on Wall Street. The chart superimposes the market’s recent performance on top of a plot of its gyrations in 1928 and 1929.

The picture isn’t pretty. And it’s not as easy as you might think to wriggle out from underneath the bearish significance of this chart.

Posted by Christopher

Filed Under: • Finance and Investing •

• Comments (4)

Sunday - May 05, 2013

Sunday - May 05, 2013

from eye sore to eye candy for $100,000 and counting

I make no judgment and offer no opinion for myself.

I’m interested in what you think of this.

She obviously had the money to achieve her desire.

I think you might agree I have the correct categories listed.

Take a look at this.

Meet the Japanese model who has spent over $100,000 on plastic surgery to look like a french doll… and is planning even more extreme procedures

Vanilla Chamu has undergone more than 30 procedures in a bid to look like a ‘living French doll’

Her next procedure promises to be her most extreme yet as she plans to undergo height lengthening surgeryBy David Mccormack

A Japanese woman has undergone a startling physical transformation that has so far involved more than 30 cosmetic procedures at a cost of 10 million yen or $102,000.

The lady, a model known as Vanilla Chamu, has said she intends to keep having surgeries until she has achieved her lifelong goal – to look like a French doll.

Photos of Vanilla prior to her first procedures reveal a rather mousy Japanese teenager whose facial features are virtually unrecognizable from the bizarre and undoubtedly more ‘western-looking’ appearance that she now possesses.

Vanilla underwent her first plastic surgery when she was 19 years old and keeps her current age a well-guarded secret.

She has become something of a cause célèbre in her native land, making countless television appearances and launching a pop career.

Her unusual appearance undoubtedly makes her guaranteed to stand out in any crowd, but she does possess a very unusual view of what a french doll should look like.

Posted by peiper

Filed Under: • Finance and Investing • Inflation and High Prices • weird stuff •

• Comments (2)

Thursday - January 31, 2013

Thursday - January 31, 2013

fraudulent behaviour was in effect saving the government money? yeah. go figure.

‘Her fraudulent behaviour was in effect saving the government money. It is the most ridiculous mitigation I have ever had to bring before a court - quite ridiculous.’

The term, “One for the books” comes to mind here.

I was tempted to file it under humor. What an odd system in place.

But I suppose it works for the Brits, so who am I to question things?

Take a look at this.

Benefits cheat mum, 23, now £64 a week better off after officials rule she is entitled to MORE than the amount she was actually stealing· Claimed £66 ($104) a week illegally but is told she can now receive £130 ($205)

· Her lawyer described mitigation as ‘most ridiculous’ he had ever brought

· Ordered to do 80 hours community service and pay £100 court costs

By Richard Hartley-parkinson

A young mother who illegally claimed benefits while working has been told she is legally entitled to more than the amount she had been stealing.

Joanne Gibbons, 23, from Upton Priory, Macclesfield, was convicted of unlawfully pocketing £3,140 ($4,964) in income support while holding down two jobs.

She originally claimed benefits legally but failed to notify the Department for Work and Pensions that she had a job at a shop and for East Cheshire NHS trust.

When she was caught out, the mother-of-one was reassessed and told she could actually claim more money for family tax credits and child benefits.

She can now receive £130 a week, £64 a week more than she claimed fraudulently.When she worked for clothing shop Strawberry Moon and the NHS trust between February 2011 and January 2012, Macclesfield Magistrates’ Court heard she would not have qualified for any payouts.

Gibbons’ lawyer Mr Julian Farley said: ‘This case is extraordinary and perhaps an indictment of the benefits system.

‘If you work out what the overpayment was on the income support over 11 months, it’s about £66 per week of overpayment.

‘Immediately after the fraud was found the income support stopped and her benefits were adjusted. Miss Gibbons was then entitled to make a claim for family tax credit and child benefits.

‘She’s now receiving £130 per week - £64 more than she was fraudulently claiming in the first place.

‘Her fraudulent behaviour was in effect saving the government money. It is the most ridiculous mitigation I have ever had to bring before a court - quite ridiculous.’

Posted by peiper

Filed Under: • Amazing Science and Discoveries • Finance and Investing • Humor • Inflation and High Prices • UK •

• Comments (1)

Thursday - July 05, 2012

Thursday - July 05, 2012

Bankers and daughters and I’m all shook up, uh huh,huh

Something of minor interest to Americans. Or maybe not because what the bank(s) did here are sure to be replicated in the USA.

This is all part of another very major scandal happening here. And since the top guy at Barclay’s bank is an American, you may be getting the news where you are.

Bob Diamond comes from a family of nine kids, his parents coming to America and raising a family. They are of Scots/Irish background. Which is neither here nor there. Just giving you some background. Mr. Diamond can not be a dummy having worked his way up to becoming the top gun at his bank and lauded by many for his business acumen. He has been running the show here for 16 years and so quite naturally people are asking, how does a fellow like this who is a millionaire many times over, with stately homes in more then one country, with friends in very high places, how comes it that he didn’t know some wrong things were happening going back a few years. How is that possible?

I don’t have any bank loans. Don’t have a mortgage, and do not carry a balance on a credit card of any significant amount. It is generally paid in full every month. So really, I don’t care about this story and I would not have followed it and didn’t at the start but for one thing.

Just to show you how shallow I have become in my dotage. Or maybe I always have been.

What got me interested in this whole thing was a woman. Wouldn’t ya know it. And why not? Is there anything else on the planet aside from puppy dogs and cute kittens, as attention grabbing as a pretty girl? Right. A beautiful car of old vintage. OK I concede that.

But women are endlessly fascinating.

Now then, with the world dumping on Mr. Diamond, who should come to his defense but his daughter. Who is an analyst at Deutsche Bank, N.Y.

Miss Diamond lost her temper and let fly using some sort of slang I never heard of before but then I haven’t got a Twitter account so far. And that’s where she let go with a tweet that I thought so tame compared to things I have seen and heard on TV, I couldn’t understand what all the fuss was about. Because what she said was reported in the msm, we all got to know her. And I must tell you, by far the vast majority of those who were critical of her are nothing more then losers who are most likely envious of her family and her own wealth. To read some of the things being said about the young (23) woman, you would think that it was immoral and criminal as well, simply to be born into a very wealthy family. Well rubbish to that.

I haven’t a clue if daddy is telling the truth or not but I am impressed that she immediately came to his defense with guns blazing. Makes a change from all the bad things we read about with regard to families warring.

OK, just so ya know. Here what it’s all about.

The London Interbank Offered Rate (or LIBOR) is a daily reference rate based on the interest rates at which banks borrow unsecured funds from other banks in the London wholesale money market (or interbank market).

http://en.wikipedia.org/wiki/Libor

WHAT DID BARCLAYS DO?

Barclays’ traders speculating on movements in interest rates were manipulating Libor in an effort to make huge profits.

Its traders were conspiring with the ‘submitters’ at the bank which lodge their Libor rates every morning. Depending on the way they were betting, traders would urge these submitters to increase the Libor rate or lower it.

Barclays’ traders also conspired with ex-employees working at other banks to try to influence their Libor submissions. During the financial crisis Barclays also fiddled the figures to dupe the market into thinking it was more financially sound than it was.

Libor is often seen as a barometer of how healthy a bank is. Just as customers with bad credit records have to pay higher interest rates, banks which are deemed in poor financial health are charged more to borrow.

Barclays became anxious that its Libor rate was higher than many of its peers and that they were fiddling the figures. It decided to join the party.

Bank of England governor Sir Mervyn King phoned chairman Marcus Agius to say he wanted the American financier out, it was claimed.

It was reported that Mr Diamond decided to resign after assessing the reaction to Mr Agius’ decision to quit.

But despite his resignation, Mr Diamond, 60, shocked the City by defiantly insisting that he would stay on at the bank despite the rate-fixing scandal.

Mr Diamond was grilled in the Commons by the Treasury Select Committee and the details could be highly embarrassing for regulators with increasing speculation that they were aware of the bank’s practices but failed to act.

Mr Diamond is said to be furious that he and the bank have been blamed for ‘lowballing’ the rates at which Barclays said it could borrow from rivals.

Bankers insist the authorities knew these rates were inaccurate but did not act because they feared the truth would destabilise the markets. It is also claimed that regulators possessed evidence of rate-fixing.BARCLAYS SPENT £100MILLION ON ITS OWN 3-YEAR LIBOR INVESTIGATION

In the wake of the scandal Barclays reveals it has spent almost £100 million pounds on a three-year internal investigation into how it had submitted inaccurate Libor interest rate prices.

In documents released ahead of Mr Diamond’s appearance in parliament on Wednesday, the bank said:

‘The bank has invested nearly 100 million pounds to ensure that no stone has been left unturned.’This involved an internal investigation supported by external counsel, which reviewed 22 million documents and more than 75 interviews.

Mr Diamond, who joined the bank 16 years ago, said in his resignation statement: ‘I am deeply disappointed that the impression created by the events announced last week about what Barclays and its people stand for could not be further from the truth.’‘My motivation has always been to do what I believed to be in the best interests of Barclays. No decision over that period was as hard as the one that I make now to stand down as chief executive.’

He went on: ‘I know that each and every one of the people at Barclays works hard every day to serve our customers and clients. That is how we support economic growth and the communities in which we live and work.’

He added: ‘I leave behind an extraordinarily talented management team that I know is well placed to help the business emerge from this difficult period as one of the leaders in the global banking industry.’

George Osborne said Mr Diamond’s resignation was ‘the right decision for Barclays’ and the ‘right decision for the country’.

The Chancellor added: ‘I think and I hope that it is the first step towards a new culture of responsibility in British banking.’

Mr Osborne acknowledged that the Government had had ‘conversations’ with the bank but denied ministers were responsible for Mr Diamond falling on his sword.Since January 2011, Barclays has been found guilty of ripping off the elderly, avoiding up to £500million in tax, manipulating interest rates, mis-selling payment protection insurance and systematically exploiting small firms with the sale of complex loans.

Chairman Mr Agius said: ‘Bob Diamond has made an enormous contribution to Barclays over the last 16 years of distinguished service to the group, building Barclays Investment Bank into one of the leading global investment banks in the world. As chief executive he has led the bank superbly.’

Lord Oakeshott, the former Liberal Democrat Treasury spokesman, this morning described the banker’s resignation as great for democracy.

‘Bob Diamond’s departure is a great day for democracy. He is the symbol of the gambling and greed we must root out of our banking system.

‘Now the top priority is to catch the criminals, break off the casinos from the basic banks and make them lend.‘We must never again let the rich and powerful in the City or the media get their hands round the windpipe of Government.’

Gottcha. Now how about seeing to it that wealthy and influential money grubbing, thieving politicians never again fiddle on their expenses. Oh yeah, and how about denying people who did dip into the public purse their seats in govt. Oh right. That’s different.

Hypocritical gas bags.

Posted by peiper

Filed Under: • Eye-Candy • Finance and Investing • UK • USA • work and the workplace •

• Comments (0)

Sunday - March 11, 2012

Sunday - March 11, 2012

fire sale as Arab state buys Britain

Didn’t think I’d even boot this thing today but. Caught a couple of item I couldn’t hold for tomorrow.

I knew from the day we arrived here that this country was for sale. A piece at a time.

There just are not the Brit billionaires available to buy things. Like Harrods. Probably once the greatest dept. store in the entire world. And a lovely tea shop. Or it was when last we visited many yrs ago when the Brits still owned it.

It really is a world turned upside down, and it’s all Bush’s fault.

How Qatar bought Britain: They own the Shard. They own the Olympic Village. And they don’t care if their Lamborghinis get clamped when they shop at Harrods (which is theirs, too)

By EDNA FERNANDES in DohaCreeping steadily above the London skyline, the Shard will be Europe’s tallest building when it is finally finished in a few weeks’ time: an extraordinary monument to glass, steel and sheer ambition.

And an appropriate symbol for the rise of its Qatari owners and their ever-growing influence here in Britain.

From the ruins of the financial crisis, this tiny Gulf state has snapped up a range of famous British assets, and if you were to take a look from the upper storeys of the Shard, quite a few would be in view.

To the east, Qatar owns swathes of the Canary Wharf financial district through its majority holding in Songbird Estates plc.

When Barclays was in trouble at the height of the banking turmoil, the Qatar Investment Authority (QIA) emerged as a white-knight investor, and became the biggest shareholder.

Over at Stratford stand the buildings of the Olympic Village – once the Games are finished this summer, QIA will take ownership.

Due west lie Harrods and, close by, No 1 Hyde Park, the world’s most expensive block of flats, also Qatari-owned.

The only time the Qataris have excited the curiosity of the British was when two of their royal family’s matching turquoise supercars were clamped outside Harrods, which they own

If I’m not mistaken, the bros. who own these cars, and they always buy matching cars together, have a newer set here. I believe their other ones were yellow.

And that was only just before Christmas. I think.

From a standing start, in the last two years Qatar has become Britain’s biggest supplier of imported liquefied natural gas (LNG).

Last year Qatari LNG accounted for 85 per cent of Britain’s liquefied natural gas imports, providing power to homes across the land.

But that figure is rising, and by the final quarter of 2011, Qatari supplies had jumped to 95.5 per cent of our total LNG imports.

For some, at least, our dependence on Qatar for a major part of our power has become a significant cause for concern. (LNG already accounts for one quarter of the UK gas supply.)

As one union leader put it: ‘They have vast sums to spend, they invest in our strategic industries and that in turn allows them to influence the type of society we are.’

Certainly, as North Sea oil reserves diminish, this tiny Gulf state has become pivotal to Britain’s future energy security and our prosperity.

It is little wonder that both David Cameron and his predecessor as Prime Minister, Gordon Brown, have been assiduous in courting the Qatari leader, Emir Hamad bin Khalifa Al-Thani, and his glamorous wife, Sheikha Moza bint Nasser Al-Missned.

more to see and read, take a look at their skyline

Posted by peiper

Filed Under: • Finance and Investing • UK •

• Comments (2)

Thursday - March 08, 2012

Thursday - March 08, 2012

the financial markets and something to laff about

This is I think, the first time I’ve ever posted anything with regard to the financial world. That’s cos when I add two plus two I always get 5 and so never took on the responsibility of balancing a checkbook. In the words of the immortal Bob Newhart, I always thought if I came within a dollar of it ....

But there is some I understand, slightly. For the really complicated stuff, seriously here, I ask the wife who while not a stock market maven is still quite knowledgeable when it comes to things like most of what you’ll see below. And she really does read the financial section cover to cover while I simply skim.

I read the easy bits and skip the complicated stuff entirely. Oh yeah. I like the pictures too.

So as I was saying when interrupted by the tea tray with the best roasted almond cookies ever made anywhere (why do the Brits call em biscuits?), I’d like to draw your attention to the following. With all the gloom and doom and talk of a falling sky, the Tech Index NASDAQ and more specifically the Qs (QQQ) which is where most of the tech company shares are, continue to do well. But it’s the Qs that interest me above all else. Damn things went from 54 to near 65 in a matter of months while I was asleep. Now they’re beyond our reach and options are out of the question. Every year like clockwork and you can check it for yourselves, after the earning season is over and done in Jan., the Qs would drop and drop along with many of the stocks that make it up. The idea was usually buy in May at the low and then sell in Jan. Always seemed to work that way. Except this year. So far, all this gloom stuff doesn’t seem to have bothered that index at all.

Oh for a really good repeat of the glorious tech bubble where I learned words like, Dell, Intel INTL, Microsoft, MSFT, Doubleclick DCLK, Earthlink ELNK,Yahoo YHOO, Amazon AMZN, The list was endless. So here. I cut out some quotes of some interest for those (like me) who care.

Hey before I forget ..... what this Medicare Tax thingy I see here? What’s with that? I’m way outta touch on this side of the Atlantic.

Fed chair Ben Bernanke warned last week that the US faces a “massive fiscal cliff” at the end of 2012 as tax cuts expire and the axe falls on $110bn of spending due to “sequestration”. Medicare taxes also kick in. “All those things are hitting on the same day, basically.

“Every time the US economy falls below the stall speed at 1.75pc it falls into recession: we have now been below that for the last three quarters,” said Albert Edwards from Societe Generale.

Profits are sliding instead of rising robustly,” he said. The 12-month “forward earnings” data have peaked, replicating the pattern seen at the onset of the bear market in 2007.

The historical relationship between bonds and equities has completely broken down over the past six months. “You can’t have a sustained period where equities are going up, while bond yields are flat or trending down,” said Mr Secker.

One or the other must give, and bears have no doubt which it will be.Meanwhile, banks parked a record €827bn back at the ECB this week. They are hoarding funds in case the credit markets seize up again, or to meet debt repayments as their bonds fall due.

In other words guys, that’s 827 billion that is NOT in the market. In our dollars that’s > $1,095,816,115,477.37

And places like Switzerland and the Caymans don’t have to report anything.

In China, premier Wen Jiabao has downgraded growth forecasts.

Credit Suisse said China’s great industrialization boom is over, with nasty implications for the commodity supercycle.

“We believe the golden age of infrastructure investment is behind us now. The golden age of the housing boom is behind us now. The golden age of export is behind us now. The golden age of policy stimulus is behind us now. Doing a head massage simply does not use as much steel as building an airport,” it said.

The Shanghai stock market has been signalling trouble for a long time, falling more than 60pc from its peak in late 2007.At the end of the day, there is still a lack of demand in the global economy.

Now back to our regularly scheduled program. After all of the above, we need something like this from the funniest comic ever.

Charlie Callas, who passed away last year and no joke about it, I’m still in mourning.

And just in case you think all this guy could do was make us laugh .....

Posted by peiper

Filed Under: • Finance and Investing • Humor •

• Comments (0)

Monday - January 23, 2012

Monday - January 23, 2012

the entrepreneurial spirit, with a boost from the brit taxpayer

Don’t ya just love the entrepreneurial spirit? Start with $2,335.75 and watch your profits grow.

Especially satisfying of course when that 2300 comes not from you, but the taxpayer. Free money. Hey,hey. What could be easier.

That’s kapitalism. Right?

I’m wondering if I can leave this place and then sneak back in as an illegal. Wonder what they’d pay me to leave? On second thought, even one hour in any jail does not sound like an inviting introduction to the world of the entrepreneur.

Illegal immigrant who arranged sham marriages leaves jail with £1,500 rehab money - and sets up business in Pakistan offering UK passports

Ashar Rathore served 7 months of two-year sentence

Given taxpayers’ money to get out of jail and leave UK

He used cash to set up shop offering passports, visas… and ‘any enquiry related to the laws of cricket’

By NICK ENOCH

An illegal immigrant and sham marriage ringleader who left prison early with a huge pay-off has used the money to set up a new business in his homeland - offering UK passports.

Ashar Ali Rathore, 33, came to the UK with his wife Nadia Qadri, 34, on student visas then faked marriages to two Polish people to gain residency.

The fraudster was jailed for conspiring to breach immigration law, but was then handed £1,500 of taxpayers’ money - on condition of leaving Britain and returning to his native country - as part of a Government scheme for rehabilitating foreign nationals.

He had only served seven months of his two-year sentence.

Today, it emerged Rathore has used the money to set up Xpress Solutions - a company providing UK passports, visas and driving licences in Kotli, Pakistan, his home country.

Among its other services, it also bizarrely offers ‘any enquiry related to the laws of cricket’.

He is not currently under investigation by the Pakistani authorities.

Jonathan Isaby, political director of the TaxPayers’ Alliance, branded the payout a ‘sick golden goodbye’.

He said: ‘When all of us are having to tighten our belts and watch every penny, pay-offs for fraudsters like Rathore at British taxpayers’ expense are an utter disgrace.

‘Ministers must urgently review the operation of the Facilitated Returns Scheme to ensure that we are not being taken for a ride.

Oh, you’re being taken for a ride alright. And this is only one case of very many.

Posted by peiper

Filed Under: • Daily Life • Finance and Investing • Justice - LACK OF •

• Comments (2)

Monday - December 19, 2011

Monday - December 19, 2011

more law and disorder and the joke named justice

Tiz always thus. One rule and law for one group, and another set of standards for another.

These stories have made the news and passed pretty quickly cos more important stories take their place. Like how the evil American empire, so described on the radio here by the lawyer of that queer traitor Bradley Manning, is treating his baby faced innocent client. The other person interviewed (for the prosecution) holds the view and correctly I believe, that Manning could not have had the time to read all 125,000 docs he stole and gave to Wikileaks. So the claim of his altruistic intention is rubbish. I sidetracked myself again. That isn’t the subject of this post.

This is.

Ok, fair is fair and if someone fiddles at the expense of the taxpayer, they damn well should face the humiliation of fines and exposure and jail time. These are the leaches that sit on fat asses passing regs and new laws and more rules that the rest of the population is made to live by and with. The average person doing the same thing sometimes does go to jail. Ah but, some things depend on who and what you are.

The crooks here are white, so far. And not members of any favored minority. They are, or were, members of the Labour Party. Think left wing. Or as Lyndon refers to it, the Lie-bour Party. I believe he has a few more colorful names as well. They’ve wrecked this country.

(this does not let off crooks of a conservative bent btw)

MPs’ expenses: jailed trio ordered to pay back legal costs

Three former Labour MPs who were jailed for fiddling their expenses have been ordered to pay back a total of £125,000 – less than half of the money spent on their court cases.But a fourth disgraced politician was spared any repayment on the grounds he is already bankrupt.

Elliot Morley, David Chaytor and Eric Illsley, exposed for claiming too much on their Parliamentary allowances after the landmark investigation by The Daily Telegraph, were told by a judge they must give back their legal aid funds and contribute to prosecution costs.

They have already been denied the “parachute” payments given to most MPs when they leave Westminster, and forced to pay back their fraudulently claimed expenses.

So that’s one little part of the expenses fiddle by crooks in control of the public purse.

Here’s another that made the news in the last week. Just a small item which set me to thinking.

Recently a fellow named James Lunn, was working for the Ministry of Justice. Which as we all know doesn’t really exist anywhere in the world anymore. In addition to the crime of being white and middle class, Mr lunn apparently has sticky fingers and has been caught with his paws in the ministry cookie jar. The headline said that he used his MOJ credit card like a piggy bank. His piggy bank. So not an altogether honest man we may all agree.

His lawyer said that his client was working in an enviorenment where everyone abused their expenses.

Oh well, if everyone does it .... Anyway, Mr. Lunn is now facing a year in jail and well deserved as this is not the first time he’s tried to glom money from the public cookie jar. You might interested to learn that the sum he stole was £3,400. Or in our dollars at the current rate. $5,270.15. Not a small sum but then not the Great Train Robbery either.

But for real chutzpah (Yiddish for nerve, in spades. ) take a look at this one. And just so you know, she’ll be entitled to draw money just for signing in when the dust settles. But whatcha gonna do? She came to this country at the age of 13 and has learned well how to fleece the infidel. She was made a Peer, the first muzzie female peer I believe. She’s a baroness FYI. Might be a token jest-ture to prove there isn’t any anti female anti islam feelings and it’s quite pc too.

Take a look at this. Has she drawn a year in the pokey for a hundred thousand plus fiddle? Uh huh. I see you know the answer already.

She was raised to the peerage as Baroness Uddin, of Bethnal Green in the London Borough of Tower Hamlets, for life by Letters patent in the afternoon of 18 July 1998, at the House of Lords.

She was the youngest woman on the benches and the only Muslim and Bangladeshi woman to be appointed to the House of Lords. She was invited to the House of Lords for her contribution to the advancement of women and disability rights, swearing in by saying “Almighty Allah” as she took her seat in the parliament. Since entering the House of Lords, besides claiming the maximum possible amount she could fleece the taxpayer for, she has supported a handful of initiatives.

In 2010, The National Executive Committee of The Labour Party suspended Uddin indefinitely from the Party in light of the expenses claim allegations.

In October 2010, Under the recommendation of The Privileges and Conduct Committee of The House of Lords a suspension is to be handed down to Pola Uddin until Easter 2012 at the earliest for claiming expenses “to which she was not entitled”. The Committee also acknowledged a repayment agreement for expenses wrongly claimed.Uddin claims on her House of Lords Expenses that a flat inMaidstone, Kent is her main residence on which she has claimed £30,000 per annum in tax-free expenses since 2005. This is said to have allowed her to also claim the second home allowance on her London property, a scheme that ostensibly exists to compensate politicians living outside London for the cost of accommodation close to Parliament. Residents living near the flat in Maidstone reportedly said they had not seen any occupiers in the flat since Uddin purchased it and that it has remained completely unfurnished, but Uddin claims: “The Maidstone property is furnished and I strongly deny that I have never lived there” Uddin’s husband even denied having a property in Kent when questioned on the issue

She also has one of the highest claims for overnight subsistence of any member of the Lords.

Uddin’s home in Wapping, where she lives and is registered to vote, is a housing association property. Spitalfields Housing Association received a public subsidy of £37.8 million in 2008. The average rent for its properties is £104 a week, a sixth of the market rate. The allegations of fraud led the Tory opposition leader in Tower Hamlets, Peter Golds, to state, “Lady Uddin is depriving a low-income family of a home which was built for the needy at public expense.” On 5 May 2009, one of the senior Lord’s official, Clerk of the Parliaments, has announced the House of Lords authorities are investigating the report by the Sunday Times. Uddin welcomed the review: “I welcome this review and will co-operate fully with him in the hope of a speedy resolution and clarity that I did not break the rules of the House.”

On 23 November 2009, Uddin’s cases was passed to the police for possible prosecution for fraud. The Daily Telegraph later reported that she was refusing to cooperate with the police investigation, refusing to answer any questions.The Crown Prosecution Service announced on 10 March 2010 that Baroness Uddin would not face any charges on the grounds that a senior parliamentary official ruled that a Peers “main house” might be a place they visit only once a month. There were no indications that the expenses would be paid back.

On 18 October 2010, the House of Lords Privileges and Conduct Committee ruled that Baroness Uddin had ‘acted in bad faith’ and recommended that she should be asked to repay £125,349 as well as being suspended from Parliament until Easter 2012.In November 2011, it was revealed that no formal mechanism existed to prevent Baroness Uddin’s return to the House of Lords, even if she refused to repay the expenses that were fraudulently claimed, leading many members of her own party to call for her to resign rather than bring the House of Lords into further disrepute.

The amount of money quoted in her case (£125,349) is probably the largest amount in any of the House of Commons or House of Lords expenses scandals.Bangladesh Mansion

Further expenses claims by Uddin were later discovered when The Sunday Times revealed that she owns a mansion in Bangladesh. The mansion was described as made out of Italian marble with tiles, mosaics and with a balcony.’ An investigation of this has been acquired to whether she does have a home in Bangladesh. The mansion was believed to be built after Uddin became a peer in 1998, costing £140,000 which was organised by her husband Komar, located in Jawa Bazar in Chhatak; this is where many of her in-laws are originally from. However Uddin claims that the land was bought by her husband’s family, purchased by Kumar’s father in 1980.

FULL UNEDITED WIKIPEDIA VERSION HERE

OH BTW .... SHE IS NOT PAYING BACK ONE SINGLE DIME.

Now then, if Mr. Lunn, thief tho he may be were a member of her privileged group .... any questions?

Posted by peiper

Filed Under: • Daily Life • Finance and Investing • Government • muslims • UK •

• Comments (2)

Saturday - November 19, 2011

Saturday - November 19, 2011

Holy Cow

You have GOT to read this!

The futures and options markets are no longer viable. It is my recommendation that ALL customers withdraw from all of the markets as soon as possible so that they have the best chance of protecting themselves and their equity. The system is no longer functioning with integrity and is suicidally risk-laden. The rule of law is non-existent, instead replaced with godless, criminal political cronyism.

...

Finally, I will not, under any circumstance, consider reforming and re-opening Barnhardt Capital Management, or any other iteration of a brokerage business, until Barack Obama has been removed from office AND the government of the United States has been sufficiently reformed and repopulated so as to engender my total and complete confidence in the government, its adherence to and enforcement of the rule of law, and in its competent and just regulatory oversight of any commodities markets that may reform. So long as the government remains criminal, it would serve no purpose whatsoever to attempt to rebuild the futures industry or my firm, because in a lawless environment, the same thievery and fraud would simply happen again, and the criminals would go unpunished, sheltered by the criminal oligarchy.

...

Alas, my retirement came a few years earlier than I had anticipated, but there was no possible way to continue given the inevitability of the collapse of the global financial markets, the overthrow of our government, and the resulting collapse in the rule of law.

Barnhardt Capital Management has closed its doors on purpose and has quite the game because it is rigged and it is run by thieves. Jon Corzine who STOLE millions from MF Global’s customers is not going to be punished at all. It’s a suckers market and leveraged to the edge of death on the EU, which is about to die. So she jumped out of the game.

Is she a looney, or is this the only smart move when the fiscal apocalypse is looming up over the event horizon and could slam down on us at any day?

PLEASE READ “BCM Has Ceased Operations” part 1 and 2, and make up your own mind and act accordingly.

More:

http://www.bizzyblog.com/2011/11/17/thank-you-ann-barnhardt-we-need-a-lot-more-people-with-her-courage-like-this/

http://jerseynut.blogspot.com/2011/11/more-calls-for-corzine-to-be-jailed-as.html

Also, this was on Rush the other day too I think.

Posted by Drew458

Filed Under: • Finance and Investing •

• Comments (4)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.